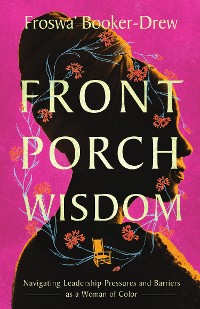

Every Airbnb Host's Tax Guide

Stephen Fishman

* Affiliatelinks/Werbelinks

Links auf reinlesen.de sind sogenannte Affiliate-Links. Wenn du auf so einen Affiliate-Link klickst und über diesen Link einkaufst, bekommt reinlesen.de von dem betreffenden Online-Shop oder Anbieter eine Provision. Für dich verändert sich der Preis nicht.

Sozialwissenschaften, Recht, Wirtschaft / Wirtschaft

Beschreibung

The complete tax guide for Airbnb and other short-term rental hosts

As a short-term rental host, you’re entitled to many valuable deductions and other tax benefits. This book—the first of its kind—shows you how to make the most of your hosting business without risking problems with the IRS

Learn everything you need to know about taxes, including:

- deductions you should be taking

- how to report your short-term rental income

- how to deduct losses and

- vacation home and tax-free rental rules.

Whether you rent your property through Airbnb, FlipKey, TripAdvisor, Craigslist, or VRBO, you want to make sure you understand these tax rules, including the new 20% pass-through deduction.

This edition includes comprehensive coverage of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Kundenbewertungen

taxation, air bnb, home, IBPA gold award, airbnb taxes 2020, vacation rentals, airbnb, IBPA, short-term rental, vacation, coronavirus, law, tax deductions, taxes for vrbo, legal, rental host, CARES act, deduction, tax reporting, nolo, small business, airbnb tax guide, Economic Security Act, award, air bnb taxes, rental hosting business, allocating costs, short-term rental income, award winner, Benjamin Franklin award, covid-19